The future is not what it used to be.

Change is happening faster, customers are demanding more and startups are eating your breakfast.

Detailed planning, long term forecasts and predictability are no longer providing confidence or delivering sufficient results. You need adaptability and a way to explore and experiment your way to the best business outcomes.

In short, you need a new way to invest, a new way to hedge…. a new way to win.

So what is it?

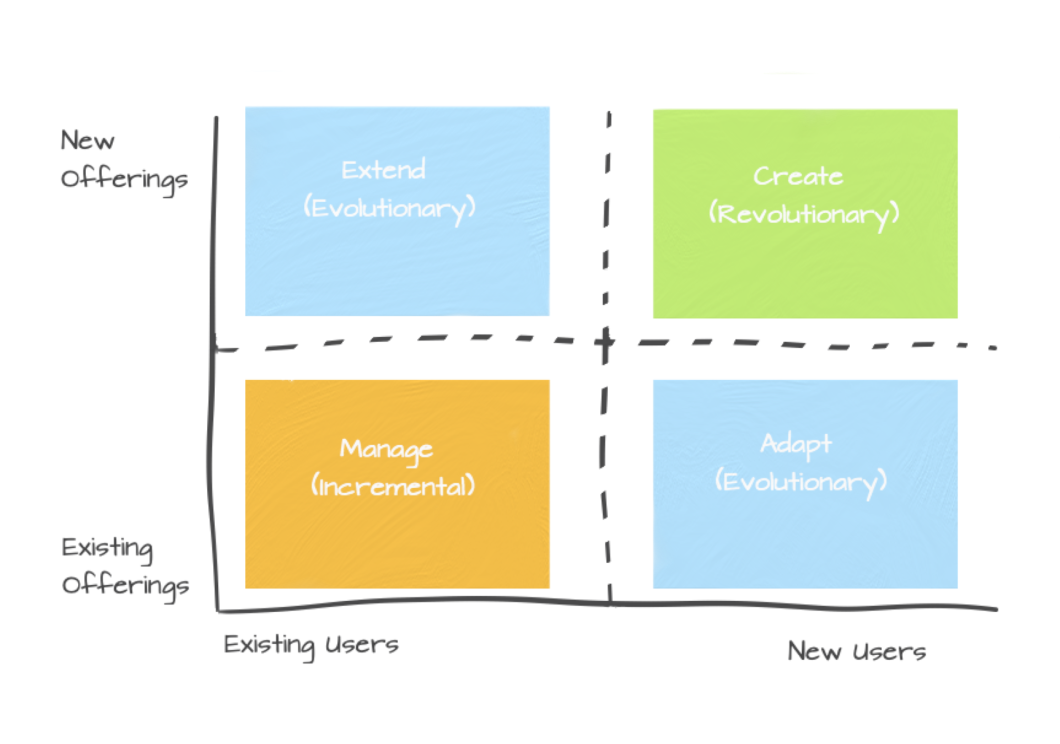

It’s no secret that the winning teams are the ones that solve customers problems the best but how do they do that when technology, customers, markets and solutions are evolving? It’s difficult, so why do some businesses seem to get right time after time?

The answer, fortunately is not that complicated but it does require a new way of thinking, some interesting techniques and a blend of some customer-centric models.

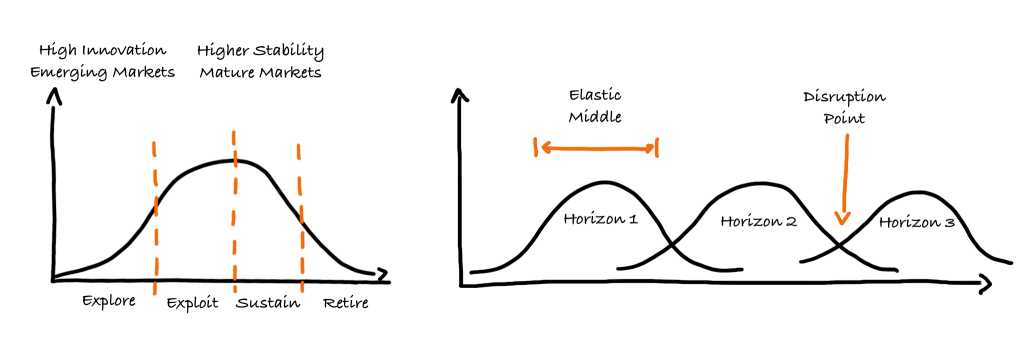

IBM used the rolling product horizons concept to great effect and turned their business around with their EBO (Emerging Business Opportunity) model. This allowed them to not only invest in the moonshots but to fund and measure the initiatives in a different, startup style model to nurture the new businesses through early stages of development.

This alternate validation and new accounting theory is core to the Lean Startup movement and it is core the ideas pioneered in Beyond Budgeting too.

But what is a Rolling Product Horizon?

The best way to explain is probably to give an example. Kodak were of course huge in the film camera era. This was a long-term and stable market. Their next product horizon, which was much shorter, was the digital camera market which they missed. However, just round the corner was the real game changer with mobile phones and digital content sharing being the longer term product. Even if Kodak had survived the first disruption point, would they still be around today?

By contrast, look at the Netflix model. Netflix understood the potential of the home entertainment market and entered what they had calculated was a short term transition stage with the ‘delivery to you home’ product. This established a brand, a presence and an understanding of customer needs. However, they alway had an eye on the digitisation of their market and invested appropriately in the future – unlike Blockbuster.

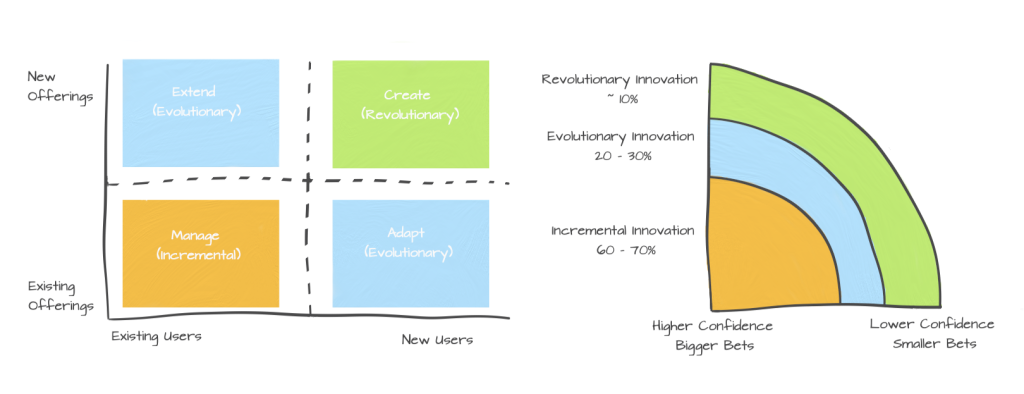

There are several models for managing these investments but one used by Google and others is to attribute: 60 – 70% of investment to incremental innovation, 20 – 30% to evolutionary innovation and 10% to revolutionary innovation.

Do you know what your next product horizons looks like? Where will your business be in 10 years and how will you get there?

Are you managing your investments to stay in the game, or just funding projects for the next 12 months?

If you would like some help in:

- Making sure that you are solving real problems for your customers

- Working towards shared goals and aligned outcomes

- Investing in innovation for the future as well as today

Then get in touch and see if we can help you get your portfolio planning, budgeting and organisational focus in better shape.